palm beach county business tax receipt appointment

Failure to have a current palm beach county local business tax receipt will result in the disapproval of your license application until such time that a palm beach county local. A copy stays with the Village.

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Businesses Based Within Palm Beach County.

. Service is provided Monday through Friday from 830 am. These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes. Constitutional Tax Collector Serving Palm Beach County PO.

At the Customer Service counter located on the 2nd floor of the City Hall Annex 120. 561 227 - 6411. Anyone who holds a County Wide Business Tax may purchase a Village Business Tax Receipt for a 2 fee.

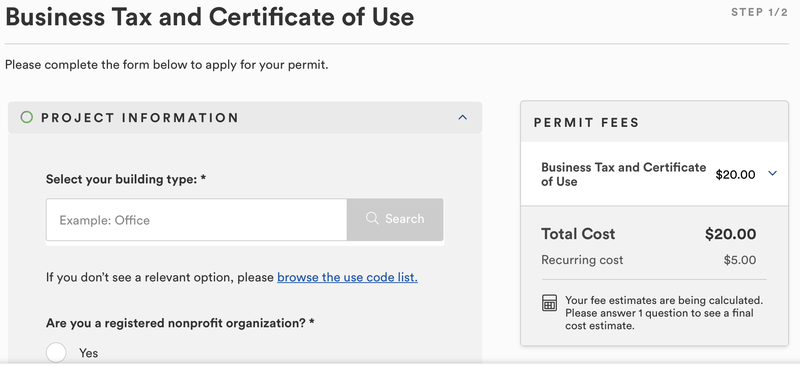

Business Tax Receipt for Short Term Rentals are only processed at our administrative office on the third floor of the Governmental Center 301 N. These fees are for the most common type of applications. Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500.

Call our Tourist Development. Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida. All other applicants will pay full fee cost.

Royal Palm Beach FL 33411. A business tax receipt is a tax levied upon all businesses within the municipal boundaries. For a full list.

Tax Collector Palm Beach County. Within Florida most cities and. Constitutional Tax Collector Anne M.

Return the original form to the Tax. Hours of Operation 800 - 500 M-F. Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us.

You must provide an active palm beach county business tax receipt. Clients moving to Palm Beach County who are establishing residency are considered Palm Beach County residents. Applicants must apply with the Village of Royal Palm Beach and obtain Zoning approval PRIOR to applying for the Palm Beach County Business Tax Receipt.

Dont wait until the last minute. Tax Collector Palm Beach County. CED Department is responsible for the issuance and collection of all Business Tax Receipts under the authority of Chapter 110 of the City of Palm Bay Code of Ordinance.

Box 3353 West Palm Beach FL 33402-3353. Commercial locations must submit the following. Tax Collector Palm Beach County.

Complete the Application for Local Business Tax Receipt. Business tax is a tax you pay to the City for the privilege of doing business in the City. Business Tax Department PO.

New business owners can apply for a Local Business Tax receipt in two ways. Make sure to select Business Tax as your appointment type. The zoning public information planner will review the request and verify the zoning district and whether the use is allowed for that specific location.

Requirements for making an appointment. Business tax is regulated by Florida Statute Chapter 205 as well as City. You are required to complete the correct application see Forms pay fees and in most cases have inspections in order to comply and be issued a local business tax receipt formerly known as occupational license.

West Palm Beach FL 33401. 4 palm beach county local business tax receipt formerly occupational license. Schedule your appointment today.

Business Tax Receipt for Short Term Rentals are only processed at our administrative office on the third floor of the Governmental Center 301 N. Palm Beach County Tax Collector Attn. Return the original form to the Tax Collectors Office to obtain a Business Tax Receipt for Palm Beach County.

Applying For a Palm Beach County Local Business Tax Receipt. Certain types of Tax Records are available. 1050 Royal Palm Beach Blvd.

For specific businesses or if you are unsure please call 561-799-4216 for fee estimates. Schedule your driver license appointment up to 60 days in advance. West Palm Beach FL 33402-3353.

Palm Beach FL 33480. Complete the top portion of the Application For a Palm Beach County Local Business Tax Receipt and receive sign off by the Royal Palm Beach Planning and Zoning Department. All businesses and professional offices within the Village must also obtain a Business Tax Receipt from Palm Beach County.

Click Here to Schedule. 301 North Olive Avenue 3rd Floor. Greenacres Building Department 5800 Melaleuca Lane Greenacres FL 33463 Tel 5616422052 Fax 5616422049 Email.

If you have a problem or question you need help with select the appropriate topic from the forms to the right. Completed Village of North Palm Beach Business Tax Receipt Application Be sure to answer all of the questions completely including the narrative and notarize the signature Completed Palm Beach County Business Tax Receipt Application Do not go to the County Tax Collectors Office until. 360 South County Road.

Monday - Friday 800 am. Box 3353 West Palm Beach FL 33402-3353. APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT.

All redemptions must be done at the tax collectors office 301 north olive ave third floor west palm beach. Palm Beach County Office of Equal Business Opportunity OEBO 50 South. What the Tax Receipt Is.

Business Tax Receipt Select this type of service if you need to apply for a new local business tax or renew your local business tax. Make an appointment at one of our service centers to process your completed application. West Palm Beach Florida Mon.

You can mail your completed application to. Our Client Advocate assists clients with web-related issues. Payment of the tax receipt does not certify or imply the competence of the licensee.

If your business is based within Palm Beach County you must provide a Palm Beach County Wide Business Tax Receipt. Dont wait until the last minute. Hours Monday - Friday 800 am - 500 pm.

You can apply for the Palm Beach County Local Business in person at six of their seven Service Centers. Our mission is to deliver the highest quality service and support to the Palm Beach business community with excellence integrity and efficiency. Please attach a copy of your current palm beach county local business tax receipt.

Business Tax Department PO.

County Business Tax Receipt Renewals Start July 1st

Business Tax Receipt How To Obtain One In 2022

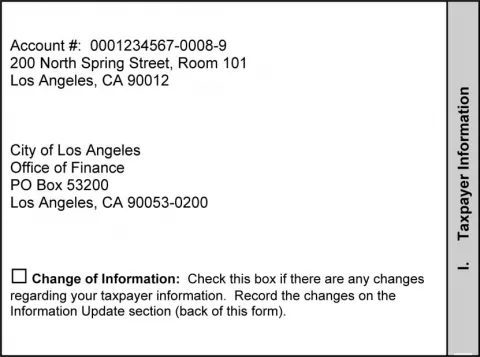

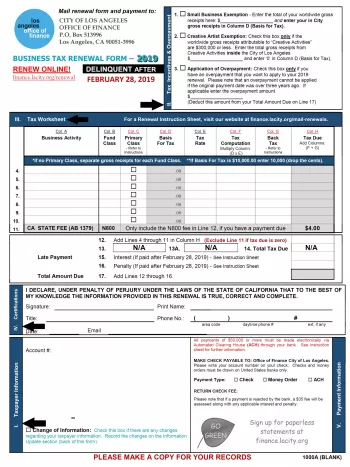

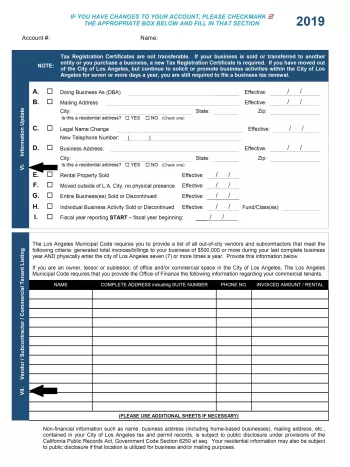

Business Tax Renewal Instructions Los Angeles Office Of Finance

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Business Tax Renewal Instructions Los Angeles Office Of Finance

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Fill Free Fillable Constitutional Tax Collector Pdf Forms

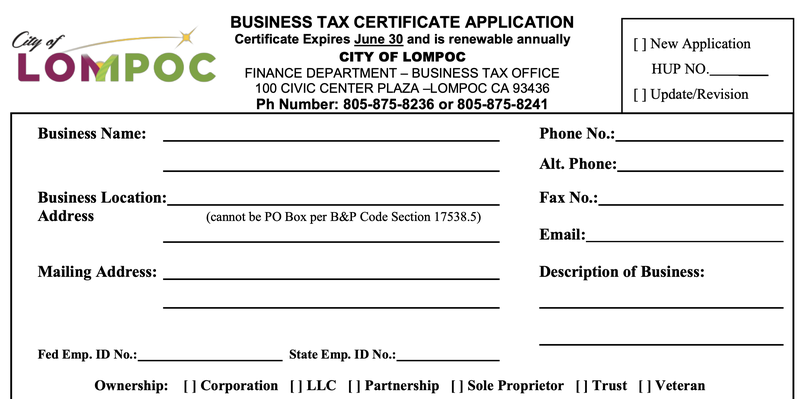

Business Tax Receipt How To Obtain One In 2022

Business Tax Receipt How To Obtain One In 2022

Local Business Tax Constitutional Tax Collector

Business Tax And Regulations Btr Division Hallandale Beach Fl Official Website

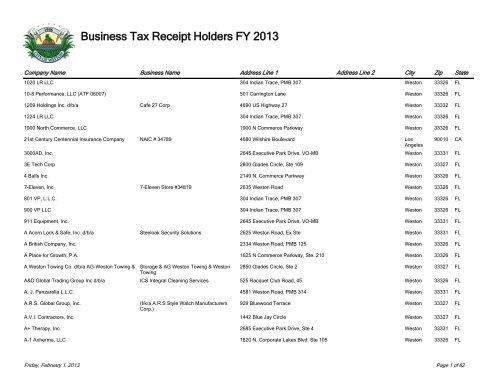

Business Tax Receipt Holders Fy 2013 City Of Weston

Business Tax Receipt How To Obtain One In 2022

Business Tax Renewal Instructions Los Angeles Office Of Finance